7 Simple Techniques For Pacific Prime

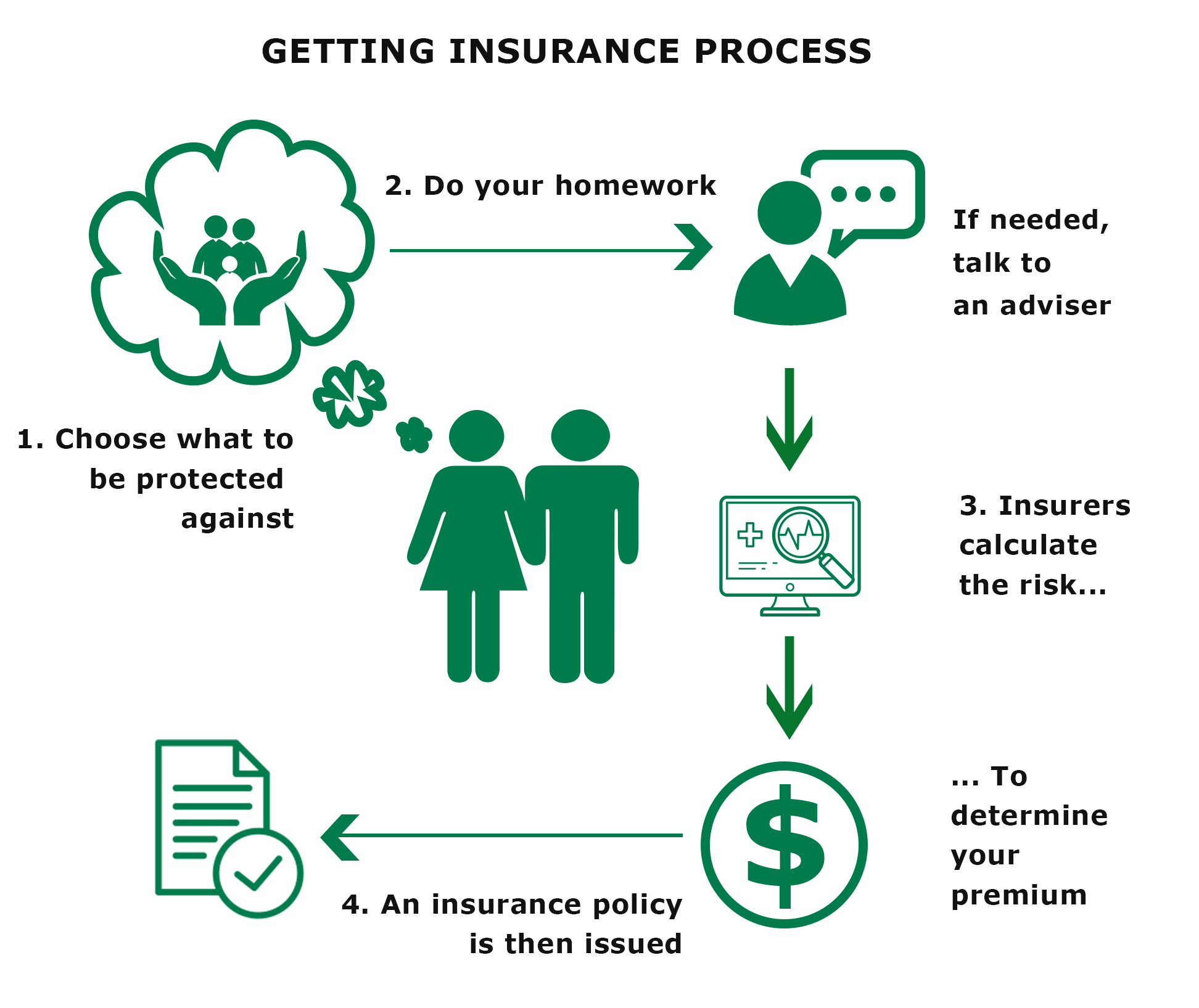

Your representative is an insurance policy professional with the understanding to lead you via the insurance policy process and aid you find the very best insurance defense for you and the individuals and things you care concerning the majority of. This article is for educational and recommendation purposes only. If the plan coverage summaries in this short article dispute with the language in the plan, the language in the policy applies.

Insurance policy holder's deaths can likewise be contingencies, especially when they are thought about to be a wrongful fatality, along with residential property damages and/or damage. As a result of the unpredictability of stated losses, they are classified as backups. The insured individual or life pays a premium in order to obtain the advantages assured by the insurance provider.

Your home insurance can aid you cover the damages to your home and afford the price of rebuilding or repair work. Sometimes, you can likewise have insurance coverage for items or prized possessions in your home, which you can then purchase replacements for with the money the insurance policy company gives you. In case of an unfavorable or wrongful fatality of a sole income earner, a household's financial loss can potentially be covered by particular insurance coverage strategies.

The 2-Minute Rule for Pacific Prime

There are different insurance policy intends that include cost savings and/or investment schemes along with regular protection. These can help with building cost savings and wide range for future generations via regular or persisting financial investments. Insurance can assist your family members keep their standard of life in case you are not there in the future.

One of the most basic form for this sort of insurance policy, life insurance policy, is term insurance policy. Life insurance as a whole aids your family members end up being protected monetarily with a payout quantity that is given up the event of your, or the plan holder's, death throughout a certain plan duration. Child Plans This kind of insurance coverage is primarily a financial savings tool that aids with creating funds when children reach particular ages for pursuing college.

Home Insurance This sort of insurance covers home problems in the incidents of crashes, natural calamities, and accidents, along with other similar occasions. international travel insurance. If you are seeking to look for payment for accidents that have actually occurred wikipedia reference and you are battling to figure out the appropriate course for you, connect to us at Duffy & Duffy Law Practice

About Pacific Prime

At our law office, we understand that you are undergoing a lot, and we recognize that if you are pertaining to us that you have actually been through a lot. https://pacific-prime-45752335.hubspotpagebuilder.com/blog/pacific-prime-your-trusted-source-for-comprehensive-insurance-solutions. As a result of that, we provide you a totally free consultation to discuss your worries and see how we can best assist you

Since of the COVID pandemic, court systems have actually been closed, which adversely influences automobile accident cases in an incredible way. Again, we are here to help you! We proudly offer the individuals of Suffolk County and Nassau Area.

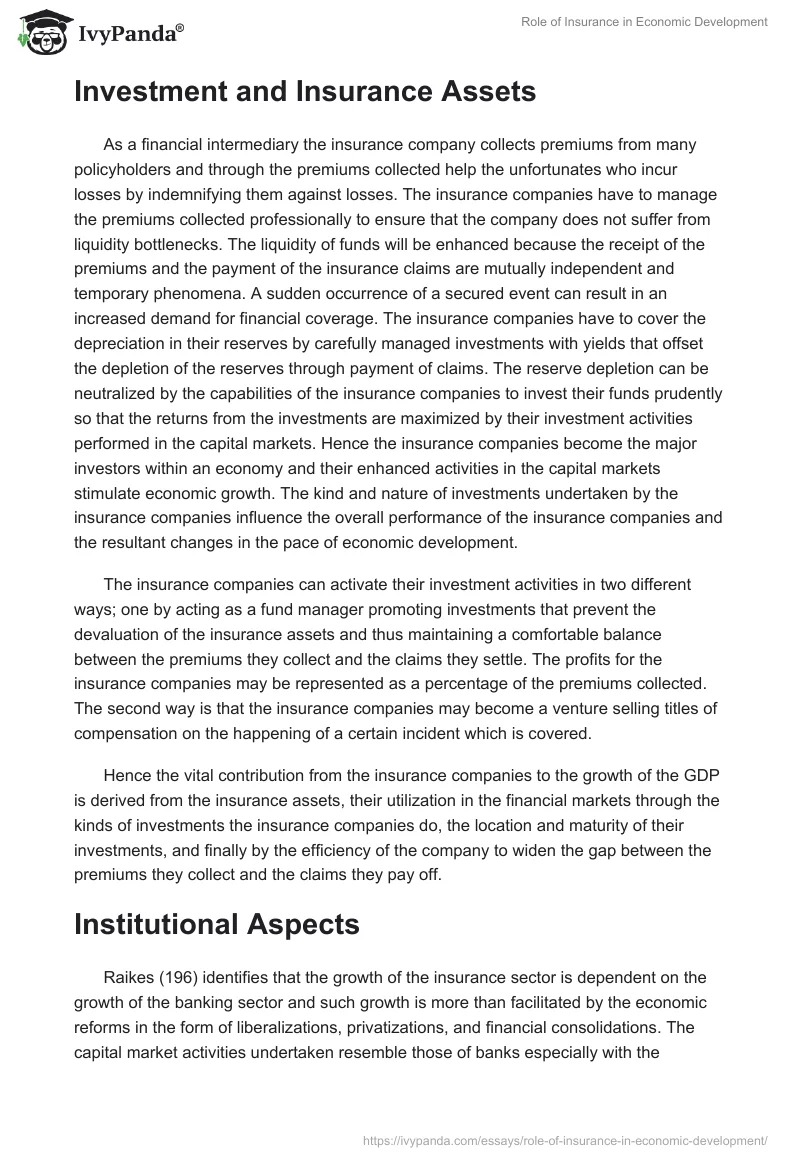

An insurance plan is a legal agreement between the insurer (the insurance company) and the person(s), organization, or entity being guaranteed (the insured). Reviewing your policy helps you verify that the policy fulfills your needs which you comprehend your and the insurance provider's duties if a loss occurs. Several insureds purchase a plan without understanding what is covered, the exemptions that eliminate protection, and the conditions that should be fulfilled in order for insurance coverage to apply when a loss occurs.

It recognizes that is the insured, what risks or property are covered, the policy restrictions, and the policy period (i.e. time the plan is in pressure). The Declarations Web page of a life insurance coverage policy will consist of the name of the individual guaranteed and the face amount of the life insurance coverage plan (e.g.

This is a summary of the significant promises of the insurance coverage company and states what is covered.

Little Known Facts About Pacific Prime.

Life insurance policy plans are generally all-risk plans. https://www.pinterest.com/pin/1093741459520423720. The 3 significant kinds of Exclusions are: Left out risks or reasons of lossExcluded lossesExcluded propertyTypical examples of excluded hazards under a homeowners policy are.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)